Getting covered: Health insurance guide for Expats in Singapore

A guest post by PolicyPal

Healthcare costs are rising and can be rather high in the world’s most expensive city for expats for the 4th year running (Economist Intelligence Unit survey 2017). Citizens and Permanent Residents use the local Medisave accounts and other government programs to enjoy lower healthcare costs. Thus, it is important for expatriates to look into private health insurance to address the high medical costs.

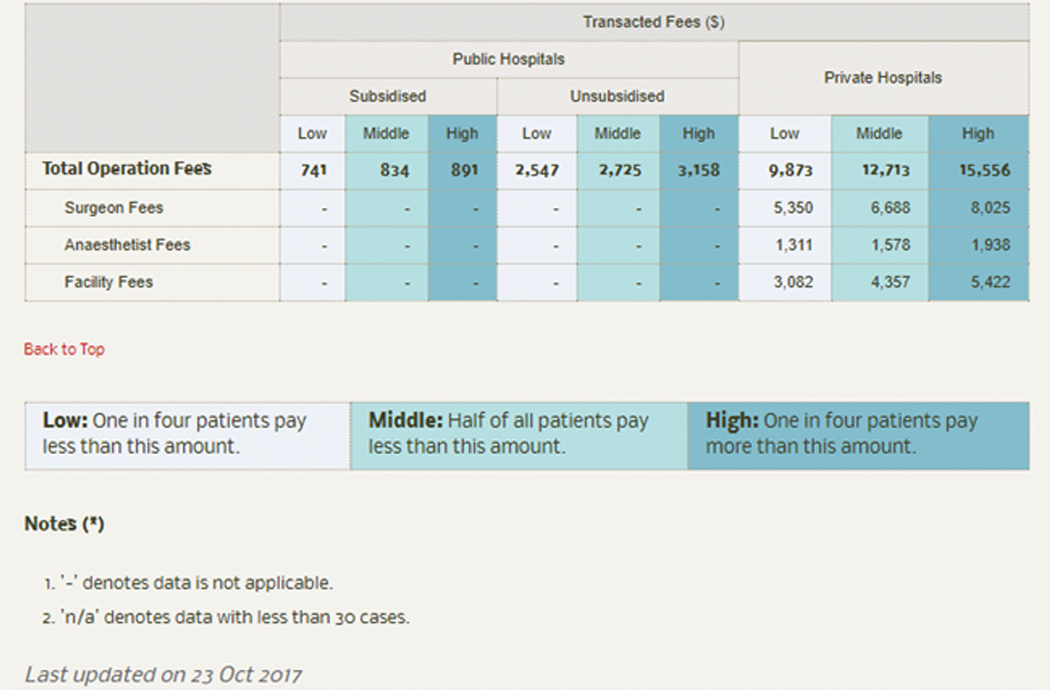

Singapore’s medical inflation rate over the past years has been well over 10%. Here is a quick reference to the operations fees for an ankle fracture (published by the Ministry of Health online);

Without the subsidies, you can expect to pay at least $2,500 at a public hospital and up to $15,000 at private hospitals. Hospital bills are expected to skyrocket in the case of complicated surgeries. Aside from deciding between public/private hospital coverage, there are other key factors to consider when choosing a health insurance policy:

1. Deductible and Coinsurance.

Both will affect the premium of your policy greatly. A deductible is the amount of money you pay for expenses before the plan does, while coinsurance is the percentage you pay after the deductible.

Example:

| Total Bill | $1000 |

| Deductible | $100 |

| Coinsurance | 10% |

| You Pay | $100 + (($1000 – $100) X 10%) = $190 |

| Insurer Pays | $1000 – $190 = $810 |

Unsurprisingly, a plan with no deductibles/co-insurance will result in a much higher premium.

2. Coverage areas.

Depending on the travel requirements of your job, you can opt for various plans such as “worldwide”, “worldwide (excluding the U.S.)”, “Asia”,etc. The premiums for the plans that include the U.S. are often heftier so leave it out if you have no plans to visit there!

3. Travel vs International health coverage.

There are some overlapping benefits between the two and it is crucial to identify your needs. International Health Insurance does not cover items like flight/baggage delays or loss of belongings but often covers your medical expenses and even emergency evacuations.

Thus, while it is important to be insured, it is possible to be over-insured when you are paying 2 insurers for the same benefit but you are not entitled to claim twice for the same bill.

Here are some plans that you can consider getting as an expat:

– International Health Insurance Plans

– Personal Accident Plans

There are of course many other factors and it can all get very confusing. Feel free to reach out to PolicyPal and we will be glad to assist! We are a digital direct insurance broker that enables individuals to buy, manage and optimise their insurance policies. We are also Singapore’s first graduate from the Monetary Authority of Singapore’s (MAS) fintech regulatory sandbox.

PolicyPal is a digital direct insurance broker that aims to make insurance easier for everyone. We now give cashback too!

Use promo code “METRO” to get 10% off travel insurance.

Disclaimer: All views expressed in the article are the independent opinion of PolicyPal. Check us out at www.policypal.com